Hello, my name is Gerald Cummings, and I'm an estate planning and elder law attorney in San Jose. I help families find peace of mind. One area that I focus on is working with families to find benefits to help pay for skilled nursing care. These benefits are provided through a program called Medi-Cal, which is a program in California that will pay for skilled nursing care. I find when I talk with clients, however, that they have a lot of myths and misconceptions about the Medi-Cal program and how it works. Among these myths are that you have to be broke in order to qualify for benefits. This is not true. Medi-Cal, in determining your financial eligibility, looks at assets and divides them into countable assets or those that do need to be spent in order to qualify, and non-countable assets, those that don't need to be spent. Examples of non-countable assets are your home and your IRA. You can have a million-dollar IRA and still qualify for Medi-Cal benefits, so it is a myth that you have to be broke. Another common myth is that if you are married and your spouse is in a nursing facility, you're going to be left with nothing. Again, this is not true. In addition to the non-countable assets like an IRA or a home, Medi-Cal will allow a married couple to keep approximately a hundred and ten thousand dollars. So again, it's a myth that you have to have nothing. A third myth that is very common is that people feel that their living trust is enough to protect them against an estate claim. An estate claim is the state of California's ability to come after you after you have passed away and recover all the Medi-Cal benefits they've paid for you. A living...

Award-winning PDF software

Medi-cal sworn statement Form: What You Should Know

Not to be taken. Forms — Central — Ontario.ca Proof of payment for all expenses reported, including a copy of the bill indicating the specific expenses. In Form Details — Central Forms Repository — Ontario.ca Proof of payment for all expenses reported, including a copy of the bill indicating the specific expenses. In Form Details — Central Forms Repository — Ontario.ca Proof of payment for all expenses reported, including a copy of the bill indicating the specific expenses. In Form Details — Central Forms Repository — Ontario.ca Proof of payment for all expenses reported, including a copy of the bill indicating the specific expenses. In Form Details — Central Forms Repository — Ontario.ca Proof of payment for all expenses reported, including a copy of the bill indicating the specific expenses. In Form Details — Central Forms Repository — Ontario.ca Proof of payment for all expenses reported, including a copy of the bill indicating the specific expenses. In Form Details — Central Forms Repository — Ontario.ca Proof of payment for all expenses reported, including a copy of the bill indicating the specific expenses. In Form Details — Central Forms Repository — Ontario.ca Proof of payment for all expenses reported, including a copy of the bill indicating the specific expenses. In Form Details — Central Forms Repository — Ontario.ca Proof of payment for all expenses reported, including a copy of the bill indicating the specific expenses. In Form Details — Central Forms Repository — Ontario.ca Proof of payment for all expenses reported, including a copy of the bill indicating the specific expenses. In Form Details — Central Forms Repository — Ontario.ca Proof of payment for all expenses reported, including a copy of the bill indicating the specific expenses. In Form Details — Central Forms Repository — Ontario.ca Proof of payment for all expenses reported, including a copy of the bill indicating the specific expenses. In Form Details — Central Forms Repository — Ontario.ca Proof of payment for all expenses reported, including a copy of the bill indicating the specific expenses. In Form Details — Central Forms Repository — Ontario.ca Proof of payment for all expenses reported, including a copy of the bill indicating the specific expenses.

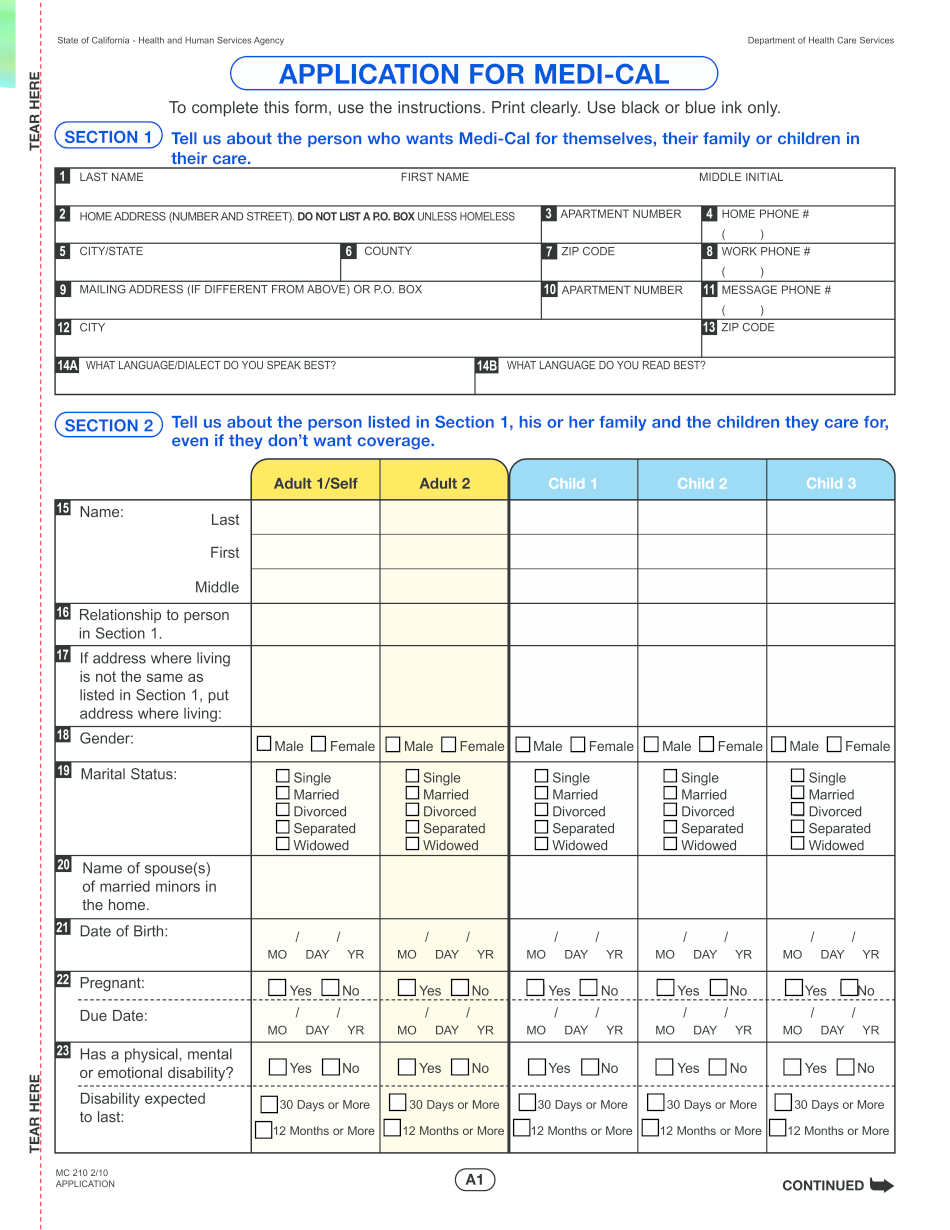

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Ca CHHS MC 210, steer clear of blunders along with furnish it in a timely manner:

How to complete any Ca CHHS MC 210 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Ca CHHS MC 210 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Ca CHHS MC 210 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Medi-cal sworn statement form