Award-winning PDF software

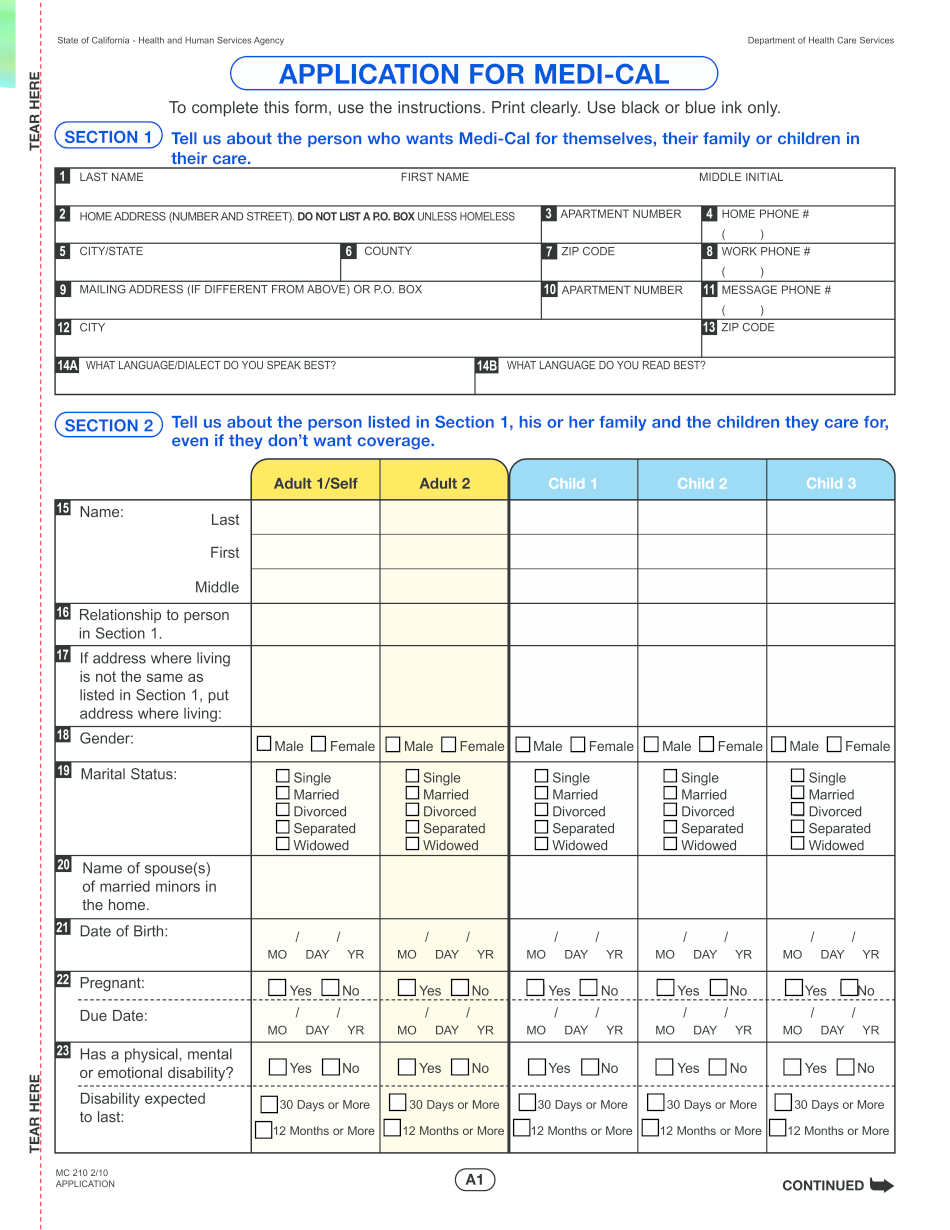

07Enrollment_Dhcs6204Pdf - Medi-Cal - Cagov: What You Should Know

A Form 990-EZ is used by an organization that files Form 990-EZ to provide information on certain financial transactions. 2023 Instructions for Form 990 Return of Organization — IRS Form 990-EZ is used by an organization that files a Form 990-EZ to provide information on certain financial transactions. 2024 Guide for Taxpayers with Respect to the Use of Certain Bank Records — IRS The Guide can help you determine the tax consequences of improperly using or using the returns of banks. Forms 990 Filing Tips: Schedule L (Transactions with Interested Persons for Interest and Gain Tax Purposes), IRS. More In File. Schedule L (Transactions with Interested Persons) — IRS Form 990-EZ is used by an organization that files Form 990-EZ to provide information on certain financial transactions. 2027 Instructions for Form 990 Return of Organization — IRS Schedule L (Transactions with Interested Persons) — IRS In Form 990-EZ, this IRS Form 990-EZ is used by an organization that files Form 990-EZ to provide information on certain financial transactions. 2028 (Form 990-EZ) for Businesses Using a Foreign Business Entity to Reduce the Tax-Exempt Status (Form 990) 2028 (Form 990-EZ) for Businesses Using a Foreign Business Entity To Reduce the Tax-Exempt Status (Form 990) — Treasury Regulations and Related Guide (TIG) 21-3-9 2028 (Form 990-EZ) for Businesses Using a Foreign Business Entity To Reduce the Tax-Exempt Status (Form 990), Information Reporting — Business Use Tax (Form 990). More In File. The Form 990-EZ is used by an organization that filed Form 990 or 990-EZ to provide information on certain financial transactions. 2029 Instructions for Form 990 Return of Organization — IRS Schedule L (Transactions with Interested Persons) — IRS. More In File. The Form 990-EZ is used by an organization that files Form 990 or 990-EZ to provide information on certain financial transactions.

Online choices enable you to to arrange your document management and supercharge the productivity of your respective workflow. Observe the quick guidebook in an effort to carry out 07enrollment_DHCS6204pdf - Medi-Cal - CAgov, steer clear of faults and furnish it within a timely method:

How to accomplish a 07enrollment_DHCS6204pdf - Medi-Cal - CAgov internet:

- On the web site with all the variety, click Start Now and move towards the editor.

- Use the clues to fill out the relevant fields.

- Include your individual info and get in touch with data.

- Make sure that you enter right information and facts and quantities in applicable fields.

- Carefully take a look at the written content from the form too as grammar and spelling.

- Refer to help you section if you have any concerns or handle our Service crew.

- Put an digital signature on your own 07enrollment_DHCS6204pdf - Medi-Cal - CAgov using the enable of Signal Resource.

- Once the shape is finished, press Done.

- Distribute the ready variety by means of e mail or fax, print it out or help save on the unit.

PDF editor lets you to make changes for your 07enrollment_DHCS6204pdf - Medi-Cal - CAgov from any online linked unit, customise it in keeping with your requirements, sign it electronically and distribute in several methods.